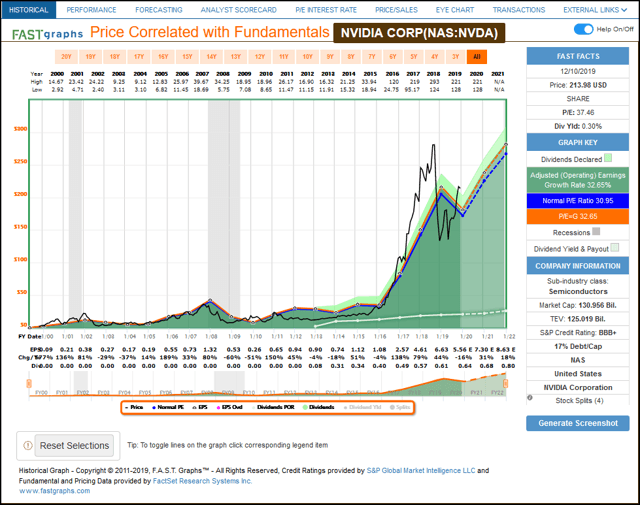

Here is how the Dividend Yield is calculated:ĭividend Yield = (dividend per share)/(price per share). NVDA, being cutting edge, and competing against other innovative companies, must constantly reinvest to maintain its competitive advantage. 5 bln to develop EV battery tech and supply by 2030 - Reuters Reuters 4 hours Alibaba Manager Not Charged in Chinas Latest MeToo Moment The New York Times 4 hours Indian shares fall after recent record highs tech, realty stocks weigh - Reuters. If you want dividends, there are plenty of good stocks out there that pay good dividends, and those are the ones you want when you retire to generate good income. Often, shareholders rely on dividends as a source of income, so a steady, reliable, and consistently growing dividend is often considered favorable by the investment community. What is Alibaba Stock Price Prediction 2030. The cash reserves are important because if a company cannot pay a dividend because of an adverse temporary operating environment the company would draw from those reserves, pay the dividend from cash on hand, and keep its shareholders happy until normal operating conditions resume. Normally, if a company pays a dividend to its shareholders, part of the EPS is shared with the shareholders, part of the EPS is deposited as cash reserves, and the rest is designated elsewhere. Dividend income may be treated differently by various types of shareholders, and tax liabilities may change accordingly, but the company issuing a dividend will have had to either pay taxes on the earnings that generated the money to pay the dividend or would have had to acquire the cash in some non-taxable event. Before a company can pay shareholders a dividend, the company must pay taxes on the earnings, and then the shareholders must pay taxes too.ĭividend income is therefore exposed to double taxation. Nvidia is the top designer of discrete graphics processing units that enhance the experience on computing platforms.The Dividend chart for Nvidia (NVDA) shows us the per share payout over time.ĭividends are a distribution to shareholders, and they define how much money a company is providing to its shareholders after all taxes and expenses have been paid. NVIDIA's Dividend Yield (%) for Today is calculated as Please refer to the last column "Forex Rate" in the above table. * GuruFocus converts dividend currency to local traded share price currency in order to calculate dividend yield.

#Nvda dividend growth full

* GuruFocus has an internal rule that if the most recent dividend payment frequency is at least 4 times a year, then the full year will be calculated according to the frequency of payment or the one-year time frame, whichever is stricter. NVIDIA Recent Full-Year* Dividend History Amount Dividend Yield % measures how much a company pays out in dividends each year relative to its share price. Payments to Suppliers for Goods and Servicesĭuring the past 13 years, the highest Dividend Payout Ratio of NVIDIA was 0.42.Other Cash Receipts from Operating Activities.Other Cash Payments from Operating Activities.Cash Received from Insurance Activities.Cash Receipts from Securities Related Activities.Many investors look for dividends as an income producing. Dividends are paid out by companies back to the shareholders. Cash Receipts from Operating Activities Dividend growth measures the year over year increase in dividends paid by a stock.

0 kommentar(er)

0 kommentar(er)